Why do trusts have to be registered using the New UK Trust Registration Service?

HM Revenue and Customs (HMRC) accepted registration of trusts with paper form 41G (Trust) until April 2017 and the new UK Trust Registration Service is a replacement online trust registration procedure, enabling trustees to maintain trust records.

The opportunity has been taken by HMRC to allow executors a registration procedure for ‘Complex Estates’.

A secondary purpose of the Trust Registration Service is for the Government to meet the EU Fourth Money Laundering directive by compiling and sharing a list of the beneficial owners of trusts. The details of the trust, trustees, beneficiaries, and influencers may be accessed by other fiscal and policing authorities although the register is not currently available to the public.

How to register a trust online.

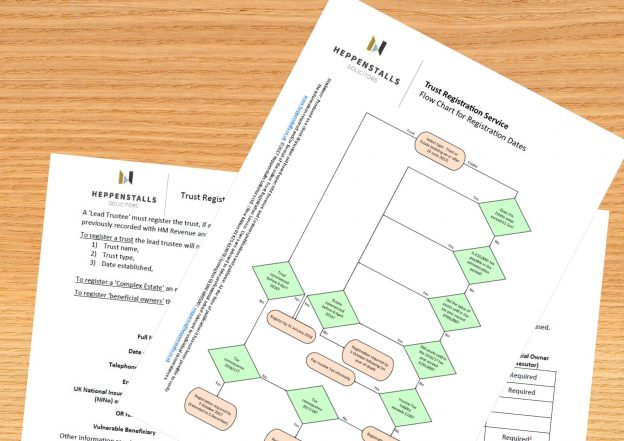

The first of the requirements for trust registration is for trustees and executors to determine if a particular trust or estate actually requires registration. There are various factors to determine the requirements for trust registration, largely depending upon whether tax is payable in a particular tax year or during the administration of a complex estate. Heppenstalls Solicitors have developed a helpful PDF flowchart to guide our Clients, trustees, executors and beneficiaries which can be viewed here to determine if and when online trust registration is required.

Registering a trust with HMRC on the UK trust register requires a ‘lead’ trustee to obtain a Government Gateway account and to collate significant facts about the trust or estate, and personal identifying information for beneficiaries, trustees, influencers or executors. Heppenstalls Solicitors have developed a helpful PDF introductory guide to trust registration documents for our Clients, trustees, executors and beneficiaries which can be viewed here to help identify the requirements and documents required for the trust registration process.

The trust registration act requires trustees to collect, record and maintain this information, even if the trust is not registerable, and to keep these records for at least five years. Private trustees need to consider whether registration with the Information Commissioner’s Office is required.

How to apply for trust registration.

The application form for new trust registration is interactive and the Government HMRC portal showing where to register a trust is here

Registration of your trust or estate cannot be undertaken by agents until HMRC provide access shortly.

If you would like Heppenstalls Solicitors to assist with trust or estate problems, please let us know at contact us, or email enquiries@Heppenstalls.co.uk or contact our experts on 01425 610078 for Steven Lord or 01590 689500 for Mrs Jennings.